With over two months of the season remaining, Rent.com analyzed Gulf Coast markets — from New Orleans to the Florida Panhandle — to appraise the headwinds and tailwinds for renters residing in or relocating to this hurricane-prone region.

Assessing risks and rewards

Home to over 16 million Americans, the U.S. Gulf Coast has been hit by eight major hurricanes in the last seven years. Despite the increased frequency of extreme storms unleashing biblical rains, flooding and storm surges, by and large, renters are taking a “batten down the hatches” approach to the risks of living in the region. Collectively, its flourishing economies and ample and relatively affordable housing stock, combined with warm weather and proximity to beaches, continue to attract renters despite heightened annual threats from hurricanes.

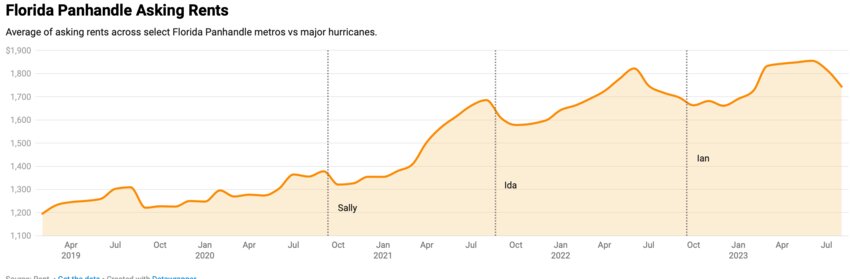

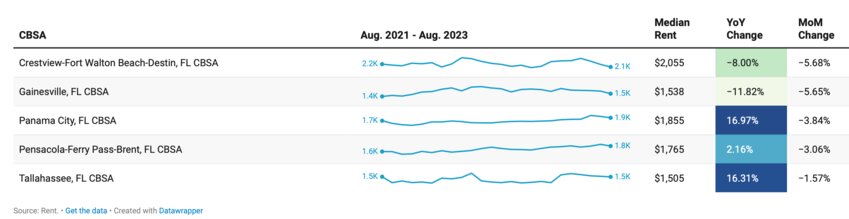

Indeed, along the Florida panhandle, in spite of a pantheon of powerful storms that have rocked coastal communities here in recent years — from the apocalyptic damage wrought by Hurricane Michael in 2018, to last year’s one-two punch dealt by Hurricane Ian, rent prices are ascendant.

In Panama City, where Hurricane Michael made furious landfall, annualized rent increases over a three-year period are off the charts, with average rents rising from $1,305 in 2020, to $1,854 in 2023, a 42.08% increase. Average prices here, however, are still below the national median of $2,052, according to Rent.'s September 2023 Rent Report.

And in the Pensacola region, still in recovery from damages inflicted by Hurricane Sally in 2020, rents on average surged by 32.49% between 2020 and 2023, with average apartment prices climbing from $1,332 to $1,764 in that period, according to Rent.'s internal data.

A similar picture emerges across Florida's panhandle. From Pensacola to Tallahassee, rents on average swelled by 28.6% in the past three years. The average price of an apartment climbed from $1,355 in 2020 to $1,743 in 2023, with annual increases at 9.53% — an indicator that despite a pandemic and threat of gale force winds, renters can't resist the turquoise waters and white sand beaches along the Sunshine State's Gulf Coast.

“[T]here's a lot of opportunity here. The economy is growing, and as a result, folks weigh that trade-off. Hurricanes are a serious risk, but we have perils associated with severe weather all over the country," said Dr. Shelton Weeks, Lucas professor of real estate at Florida Gulf Coast University.

Dr. Weeks noted that renters recognize the risks associated with living in hurricane zones, but often weigh them against the Gulf Coast's high quality of life, its year-round temperate climate which allows for an abundance of outdoor activities, and an advantage among most renters of not having to shoulder direct storm-related costs to damaged properties.

Institutional safety nets and higher prices

What's more, an infusion of government capital, which includes economic stimulus for clean-up and reconstruction, as well as a host of other federal subsidies, acts as a safety net, catalyzing economic growth while blunting the immediate aftershock of extreme weather events for homeowners and renters alike.

Some renters in hard-hit counties along Florida's Big Bend region, for example, which recently sustained damage from Hurricane Idalia, will qualify for federal disaster relief, including temporary housing and financial assistance to cover property loss and other expenses, according to FEMA.

In the meantime, increased frequency and intensity of natural disasters — from hurricanes and flooding to tornadoes and wildfires — pose serious challenges to rental housing stock in communities from coast to coast.

According to FEMA data, 40 percent of occupied rental properties across the country – around 17.6 million units — are located in regions with expected annual losses due to hurricanes and other severe weather events. Around 6 million of those units are in areas with “relatively" or “very high" expected losses.

The takeaway for renters: As older, more vulnerable housing is replaced by newer stock at higher construction costs, there will be continued upward pressure on rent prices.

Experts on Gulf Coast rental markets like Dr. Weeks point out other challenges for tenants in hurricane-prone areas. In the wake of destructive storms, soaring insurance premiums, expensive property upgrades to meet modern building code requirements and inflated construction and labor costs after severe weather events are expenses often passed on to tenants.

“[T]he folks that are running apartment complexes, their cost of business goes up. And like any business, if they want to preserve their margins, they have no choice but to pass those costs along, to the extent they can, to the tenants, their customers," said Weeks.

Post-hurricane rental demand

Another challenge for renters in the wake of devastating storms comes from an uptick in displaced homeowners flooding the rental market, driving up demand and often triggering post-hurricane rent spikes.

Following a direct hit last September from Category 4 Hurricane Ian — one of the costliest U.S. weather disasters on record — vacancy rates in the Fort Myers market fell in the storm's wake from 11.8% in Q4 of 2022, to 8% in Q1 of 2023 — a 32.2% decrease in available units, according to Rent. data. The plunge in vacancies can be attributed, in part, to displaced homeowners entering the rental market while waiting out repairs to their houses.

Average rent prices also took a hit in the wake of Hurricane Ian. The pre-Ian market was witnessing a significant run-up in rents in the Fort Myers area, with the average prices climbing to a high of $2,346 in early 2022 — a YoY increase of 55.29%. In the hurricane's aftermath, average rents spiked to a high of $2,512.50 in January 2023.

Today, as the market steadies amid rebuilding efforts and the introduction of new housing stock, average rents have come down, currently at around $2,012.50, a -4.93% change year over year.

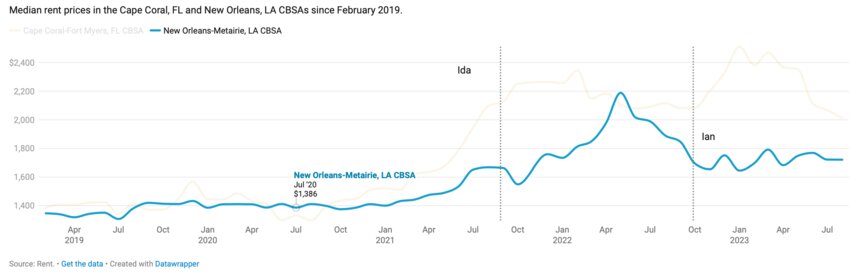

Looking beyond Florida's panhandle, despite being pounded by Hurricane Ida in 2021, rent prices in New Orleans continued to rise. Between 2019 and 2023, prices climbed from $1,382 to $1,721, an overall change of 24.57%.

Inbound migration leads in the New Orleans-Metairie region rose too, from 6.24% in the first quarter of 2022 to 22.39% in the first quarter of 2023.

Across the Gulf Coast, inbound leads in major markets that have experienced Category 3 hurricanes or higher in recent years have held steady or are seeing an uptick in interest from prospective renters.

Learning to live with nature

In the near term, Gulf Coast communities are learning to better prepare for and adapt to the increased intensity of hurricane season, improving housing stock — from apartments and condos, to single-family homes — to better withstand high winds, dangerous debris and flooding.

While the gradual phaseout of aging housing stock will contribute to near-term rent increases, it also adds significant desirability and economic value to the region and, more importantly, plays a critical role in mitigating risk of injury and severe property damage. In markets throughout the U.S. Gulf Coast, the hurricanes are here to stay, and so it seems, the renters are too.

“That's the bright light. We've learned a lot from these storms. We're getting better at what we're building," said Weeks.