Americans eagerly anticipate payday.

For some, it is an opportunity for a little well-deserved self-indulgence through shopping, dates, and dinners after weeks of hard work. For others, it is a moment of financial respite for paying off overdue bills and making monthly debt and mortgage payments. And while payday is universally a good day, it doesn't come at the same time or same frequency for everyone.

State regulations on pay frequency vary. For example, Alabama and Florida do not specify when and how frequently employers must pay their employees. On the other hand, Arizona requires that employees be paid two or more days every month, with the gap between each payday being at most 16 days.

At the federal level, the Service Contract Act stipulates that any wage payment be "timely," leaving the definition of a "timely" payment to the states, according to law firm Abrahams Wolf-Rodda. The only condition is that payments are provided at least semimonthly.

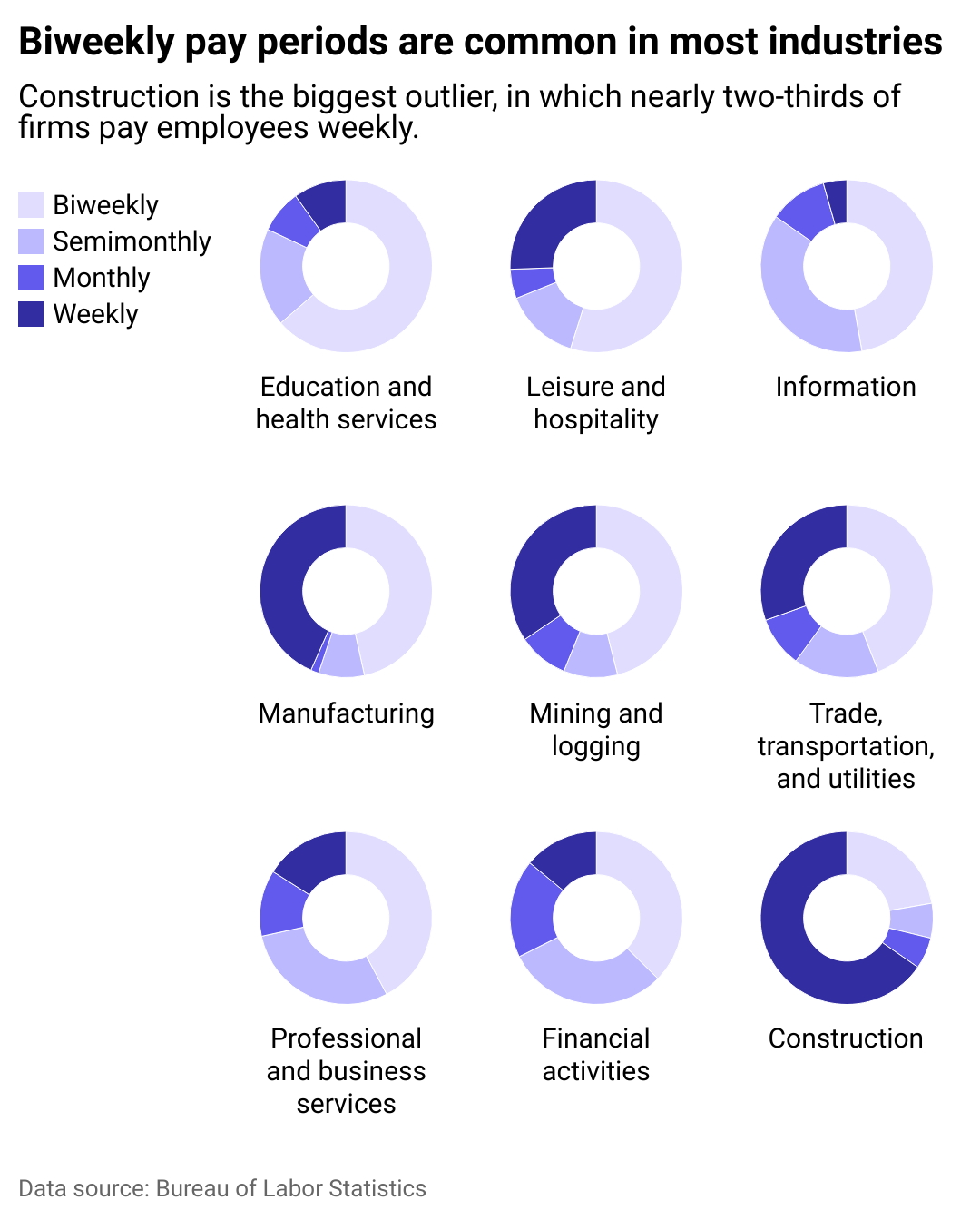

Xactly visualized and analyzed how pay periods compare between industries, using 2023 Bureau of Labor Statistics data.

The standard U.S. payday schedule formats are weekly, biweekly, semimonthly, and monthly. For about 80 years, the biweekly format has been the most common method of scheduling employee pay in almost every industry, save for construction, due to the ease it provides employers with budgeting and calculating benefits.

A biweekly pay system is one where employees receive their pay every other week, amounting to 26 paychecks annually. A semimonthly pay schedule is one where employees receive one paycheck in the middle of a month and another toward the month's end, amounting to 24 paychecks.

Biweekly and semimonthly pay schedules are more common in industries dealing with such services as information technologies, leisure and hospitality, and education and health services, according to BLS data. Federal employees also get paid biweekly.

While many industries pay biweekly or semimonthly, the construction industry is an outlier, with around 2 in 3 companies paying employees weekly, per BLS data. This is primarily due to a precedent set by the Copeland Anti-Kickback Act, which mandates that people working on public works projects covered by the Davis-Bacon Act receive their pay weekly. Furthermore, cash flow in the construction industry is more or less weekly, making weekly pay easier for the employer and employee.

In recent years, however, to attract more workers in a tight labor market, some companies have started offering narrower pay schedules, going so far as to provide pay on the same day in what is known as "on-demand pay." These higher-frequency pay periods, however, can result in higher accounting expenses. That said, it's one way employers seek to attract workers in light of inflation and the Great Resignation of 2021, where resignation rates in the country reached levels unprecedented since 1970.

Whether you're on the traditional biweekly payroll or among those receiving on-demand pay, these payment schedules are likely to change alongside changes in industry cash flows and accounting requirements. But one notion that will always be true: Payday is a good day.

Story editing by Shanna Kelly. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on Xactly and was produced and distributed in partnership with Stacker Studio.